After an outstanding year for tech in 2021, with record-breaking investments and aggressive hiring campaigns, a wave of layoffs is here.

In fact, tens of thousands of tech workers globally were laid off in the first three weeks of November alone.

Layoffs.fyi, a website that monitors tech sector data internationally, showed that 849 tech companies laid off nearly 137,000 workers in 2022, with a large chunk of those – 42,000 – losing their jobs this month.

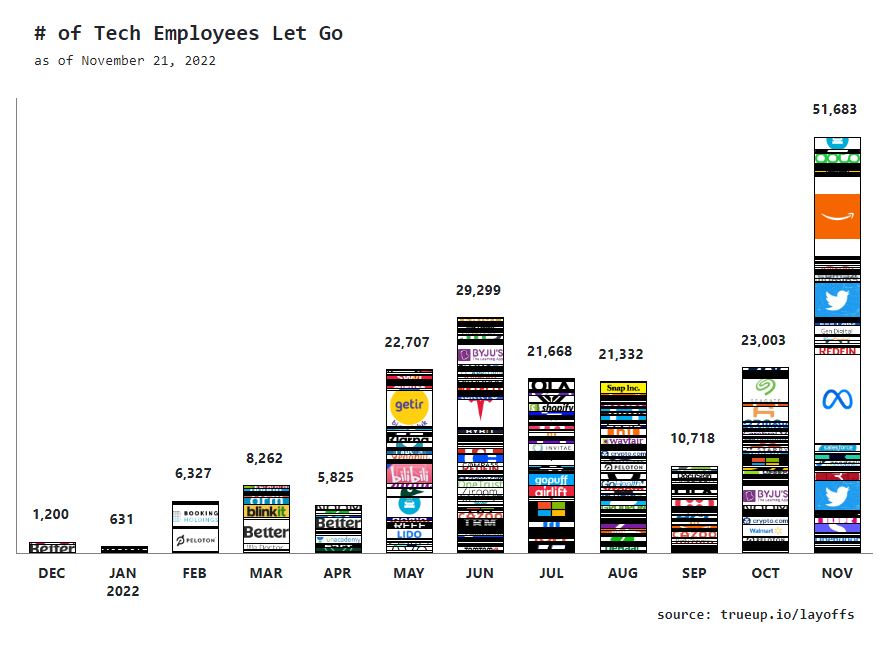

Another site, TrueUp, showed November’s layoff figures reaching nearly 52,000, people and estimated that over 200,000 workers have so far been impacted by the unfolding crisis.

Global tech sector figures from TrueUp show a massive wave of layoffs is taking place over November. (TrueUp)

Sivan Avihud, founder at Link2USA – a consulting firm providing solutions for tech companies that seek to expand their business in the US – said that the situation is serious.

“This is the main thing that people are talking about over dinner and in general,” Avihud told The Media Line. “We’re getting into the holiday season, and it feels like this is just the beginning and more companies are going to be doing layoffs in Q1 after the holidays.”

Sivan Avihud, founder at Link2USA. (Courtesy)

Avihud believes that the downturn represents a market correction after a particularly exceptional 2021, in which many companies went on hiring and spending sprees.

“Every week there are 10,000 people being let go,” she said. “In 2023, we’re expecting to see in Q1 and Q2 more layoffs.”

In Israel, roughly 6,500 workers have lost their jobs so far since the start of 2022, according to the Lastartup website, which monitors layoffs in Israeli tech companies. Of the 104 firms from a wide variety of fields that laid workers off, 11 shut their doors completely this year.

The figures emerging from the US and Silicon Valley in particular have so far dwarfed those figures. Meta recently announced it would be letting go of 13% of its workforce, or some 11,000 workers, while Amazon decided to lay off thousands and Twitter slashed half of its workforce following Elon Musk’s takeover.

The brunt of the crisis is currently mainly centered in the US, has not yet reached the startup nation, and is not expected to do so for a few more months, Avihud said.

Nevertheless, she is optimistic that things will return to normal in mid-2023.

“Companies are still hiring and there is still competition for talent,” she said.

Assaf Patir, chief economist at Start-Up Nation Policy Institute, also believes that despite the wave of layoffs there is no reason to panic about the tech industry and its future prospects.

Assaf Patir, chief economist of the Start-Up Nation Policy Institute. (Micha Loubaton)

Patir told The Media Line that the layoffs in Israel are likely being caused by a number of global factors and possibly signal the beginning of a recession.

“There are supply chain issues, there’s a war in Ukraine and there’s a general slowdown in the economy,” Patir said. “It also affects the tech [sector]. You might say that hi-tech is particularly vulnerable because especially in 2020 and 2021 valuations and investments skyrocketed.

“Everyone said the valuations were too high and there had to be some corrections,” he continued. “You could say there was a bubble and it burst, or you could say that there was a correction.”

Though the numbers that have emerged so far are less than promising, Patir insists that we will need to wait a few more months for final data to emerge about tech employment in 2022. Israel’s Central Bureau of Statistics on Sunday released a report showing that open job postings in the sector were down 30% over the past eight months.

“The general feeling that we’re getting is that there has been a substantial wave of layoffs, partly offsetting the huge increase in hiring that happened in 2021,” Patir said. “In Israeli hi-tech, about 5% of employees are fired every year more or less, about 1,500 people in total.”

With rumors of a possible recession being added to the mix, firms and investors have begun tightening their belts as they wait for the economic uncertainty to clear.

“Everyone is looking at whether we are at the beginning of a big recession or is this just a temporary minor slowdown that we will get out of in a quarter or two,” Patir said. “I think no one knows the answer and I certainly don’t.”