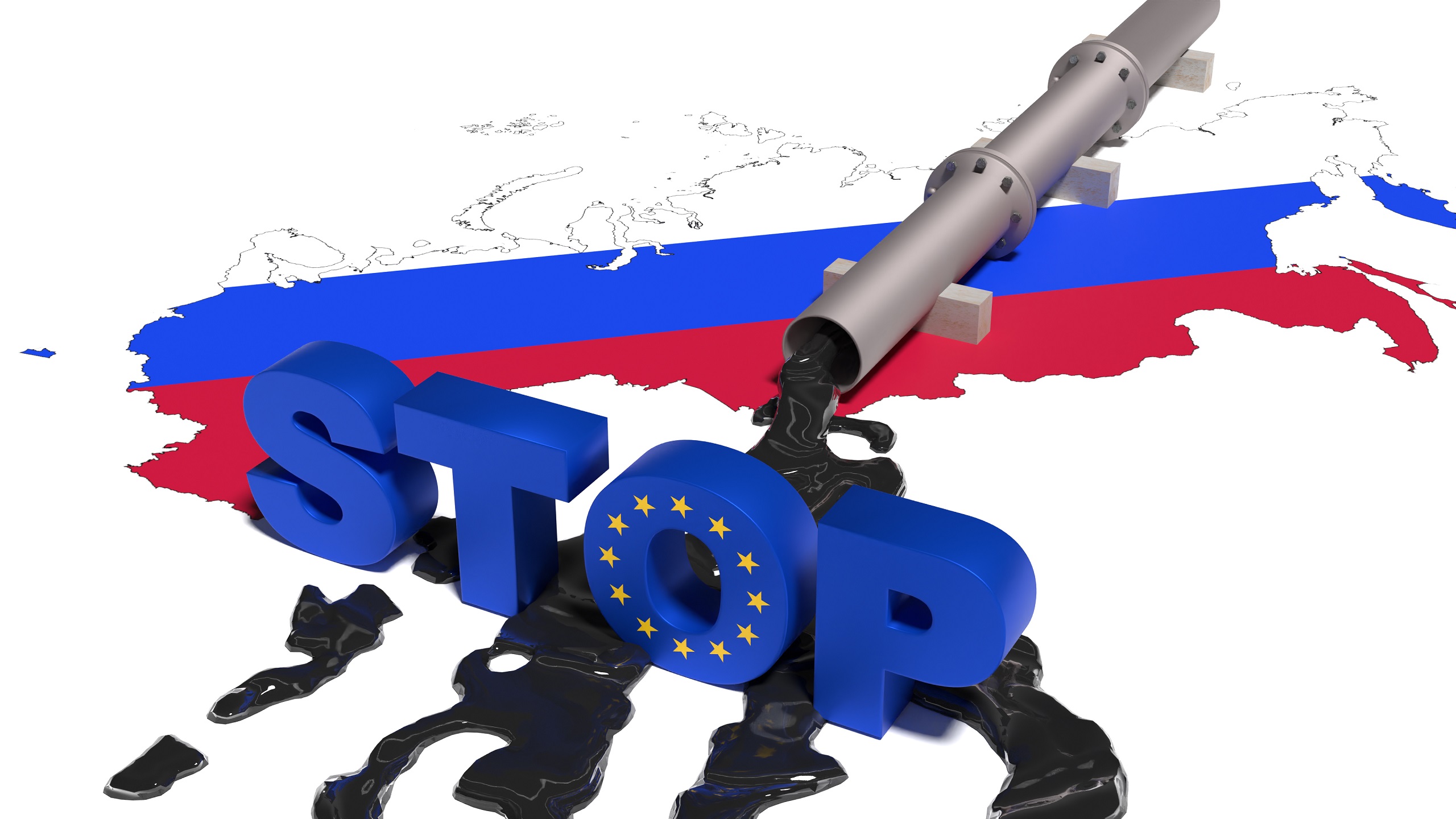

EU To Boycott 90% of Russian Oil by End of Year

Lebanon, Yemen especially vulnerable to higher energy prices produced by sanctions, experts say

European Union leaders in Brussels agreed on Monday night to ban the seaborne import of Russian oil – about two-thirds of the total − by the end of 2022. And while landlocked Hungary, Slovakia, and the Czech Republic will continue to receive Russian oil via the Druzhba pipeline, Germany and Poland have pledged to voluntarily forgo it, bringing the total cut in imports to about 90%.

This is the sixth round of sanctions imposed by Europe on the Russian Federation since the war in Ukraine began.

Talks on an oil boycott had been taking place since the beginning of May. However, they were stalled because Hungary wanted to continue to buy Russian oil.

The sanctions are expected to cause global oil prices to rise.

In the Middle East, some countries could suffer collateral damage; others will benefit.

Nader Itayim, Dubai-based Mideast Gulf editor at Argus Media, told The Media Line the countries that will most benefit are the region’s oil exporters.

“Saudi Arabia, the UAE, Kuwait, Iraq, Oman, and even Iran despite the sanctions will all be benefiting from $100+/barrel oil,” he said.

Itayim explained that higher prices translate into higher state revenues, which first will help these countries to alleviate any short-to-medium-term budgetary issues that they may be facing, possibly because of COVID-19, and second finance their plans to diversify their economies away from hydrocarbons.

The region’s oil importers will suffer. He cited Lebanon, Jordan, and even Israel.

For them, he said, “higher oil prices translate into higher import costs for the state, which put pressure on state finances and foreign exchange reserves.”

Robin Mills, CEO of Qamar Energy and author of The Myth of the Oil Crisis, explained to The Media Line that while the increase in oil prices benefits exporters and hurts importers, there are other factors that are important to consider.

While oil-importing countries such as Egypt, Jordan, and Lebanon suffer from higher prices, they may to some extent recover from higher remittances from their citizens working in oil-exporting states and from aid from oil-exporting governments, he said.

On the other hand, he continued, “the non-oil sector in oil-exporter [countries] is also negatively affected by higher prices, especially in countries where oil price rises are passed on to domestic fuel prices, such as the United Arab Emirates.”

The negative effects are reflected in fuel shortages, higher fuel prices, and general inflation, Mills explained. “This can be increased when governments have to cut back on fuel subsidies,” he noted.

So far, he continued, “we have not seen much of that in the region, but it happened in previous situations of rising food and fuel prices.”

For now, it has mostly affected Lebanon, but Egyptians and Iranians could also suffer if they have to reduce subsidies, Mills said.

Mohammed al-Qadhi, a Yemeni political adviser at the Geneva-based Centre for Humanitarian Dialogue, told The Media Line that Yemen is one of the countries most hurt by rising oil prices.

His country is already harshly affected by the Ukraine war due to the lack of wheat exports.

Concerning the high oil prices, Qadhi added, Yemen will be badly hurt because it imports crude oil for the local market and for power stations.

Yemen is normally an oil producer, he explained. However, because of the civil war that began in 2014, it halted production.

Now with the truce, Qadhi continued, “only a few companies resumed their production of oil, but it is not that much and … it will be shipped to sell it outside of Yemen.”

Yemenis are suffering a great deal because of the price of fuel, which is already very high, he said.

This, he explained, has resulted in a black market all over the country, especially in the areas under the control of the Houthis. “This black market is generating millions according to international organizations,” Qadhi said.

Already now, before the latest jump in oil prices is felt, people and vehicles wait in long lines to get gasoline, he said. This is happening both in the Houthi-controlled areas and in Aden, the headquarters of the internationally recognized interim government.

“Yemen is already facing a lot of problems, and if oil prices rise more, it is going to face more problems,” Qadhi said.

Mills said governments could implement policies to reduce people’s suffering from increases in the cost of energy.

“They can phase in subsidy reductions, offer other support to lower-income citizens, and improve non-oil options,” he said.

Qadhi, however, is not optimistic about the Yemeni government’s ability to act.

He described the Yemeni government as “toothless” when it comes to alleviating the effects of higher oil prices.

“It is not capable of doing anything,” he said. “They are depending on the Saudis for fuel in the gas stations, and we don’t know how much longer they are going to aid Yemen,” Qadhi said.

Itayim said the answer is for governments to plan and think ahead.

“In a word: planning,” he said. In the past, he explained, “particularly in some GCC [Gulf Cooperation Council] countries, you would see clear shifts in policy between times of boom [high oil prices] and bust [lower prices].”

In boom times, Itayim added, “you’d see governments regularly implement public sector wage hikes and give generous handouts to the people, instead of diversifying and reinvesting in the economy, while in times of bust, public spending would really be scaled back.

“I think those days are behind us now,” he noted.

Itayim believes that governments in energy exporter countries will continue to focus on strengthening their economies and balance sheets, to make sure they are better prepared for any future price falls.