Entrepreneur Jonathan Medved is a leading venture capitalist and is the founder and CEO of equity crowdfunding platform OurCrowd, which has received over $1.9 billion in commitments, and deployed capital into more than 347 portfolio companies and 39 funds across five continents since it was founded in 2013. OurCrowd’s startups have recorded 59 exits to date. OurCrowd has its global headquarters in Jerusalem, with offices in Herzliya, Hong Kong, London, Madrid, New York, San Diego, Singapore, Sydney, Tel Aviv, and Toronto. Medved, 66, was named by The Washington Post as “one of Israel’s leading high tech venture capitalists” and by The New York Times as among the “top 10 most influential Americans who have impacted Israel.” He has backed over 400 tech startups as a venture capitalist and angel investor. Born in San Diego, California, he moved to Israel four decades ago while in his 20s. He is married to Jane and has four adult children.

TML: Welcome to The Media Line.

Medved: It’s great to be here, Felice. Thank you.

TML: Jonathan, how large a fund is OurCrowd today?

Medved: We’re a platform that allows individual investors from around the world to invest in Israeli and other global startups. Today we’re managing about $2 billion of assets. We’ve been at this for about 10 years, and we have 220,000 investors worldwide registered on the platform.

OurCrowd CEO and founder Jonathan Medved, Dec. 15, 2016. (Yirmiyahu Vann for OurCrowd/Creative Commons)

TML: Given the publicity the world of startups in Israel has received, there must be those who believe a company is created, papers are filed, and vast exit checks are written. What is the startup world really like?

Medved: (Laughs) I wish it was so easy. It would certainly make my life a lot easier, and make a lot of my investors very happy. But the reality is that these companies, to build them, take almost superhuman effort. And the key to Israel’s success in this important and critical business for the country has been our entrepreneurial class. Israel punches way out of its weight class, if you will, in terms of our ability to create companies of size. Today one of the key metrics is what’s called being a unicorn. And a unicorn is a company that’s worth $1 billion and not yet publicly traded. Now, there are about a thousand unicorns in the world today. Israel has about 100 of them, or about 10%, which is not in line with our percentage of the world population. We are about 10 million people. We should have one unicorn. Instead of one, we have a hundred. So, literally, from a venture capitalist perspective, we are about two orders of magnitude over-indicated, if you will, which is statistically very significant for the country. And what this has led to is almost a tsunami of investment that’s flowing into the country, which is a very good thing for Israel. Last year, there was $25 billion invested in Israeli startups, $25 billion. This year in the first half, already $10 billion. So it’s slightly down from the base of last year, which can be expected given the retreat that there’s been in the tech stock market in New York and whatnot. But the retrenchment, if any, has been rather modest so far. Israel is a world power in the startup game.

TML: It’s absolutely phenomenal when you talk about the numbers in comparison to the population of the country. Also, I just think though with that perception are significant issues. There’s also losses in the value of many of the high-tech companies right now. There are huge layoffs and even company closings. So that’s the flip side of what we’re seeing at the moment. Now you’ve been quoted as saying it’s a good time to find a sale. How concerned are you about what’s happening in the marketplace?

Medved: Look, any reasonable investor is watching the markets very carefully. But you have to look at the market two ways: One as a holder of investments, and of course the investments we made $2 billion so far. We’re working very closely with the companies to make sure that they have adequate runway for future growth, that they’re staying close to their customers, that they’re cutting their expenses, that they’re really staying on their game, as it were. But in terms of new investments, we’re excited. Because the reality is that when the prices come down, which they have across the board, it makes it hard for your existing portfolio, but it makes it great for the new investments you’re going to make. And so we have many, many thousands of investors who are going to OurCrowd and looking for companies that are on sale. Because innovation isn’t going to stop. The fact that markets have a retrenchment, that financial reality is cyclical, it goes up, it goes down, it goes up, it goes down. But the trick is buy when it’s down, and sell when it’s up. That’s not rocket science, it’s sort of Basic Finance 101. And we’re seeing that play itself out very much so in the venture capital arena.

Jerusalem Mayor Moshe Lion, OurCrowd CEO Jonathan Medved, and Israeli President Isaac Herzog, at the 2020 OurCrowd Global Investor Summit in Jerusalem, February 2020. (Courtesy OurCrowd)

TML: The word “recession” has been floating around. Are we in a recession? Are we heading into one?

Medved: Look, I’m not an economist, that’s above my pay grade. So, I don’t believe yet that we are in recession relative to the key metrics, but it’s possible that we could enter one in the near future. I don’t think that that’s the critical issue for us as venture capitalists. Because we don’t look at what’s happening quarter to quarter. We’re looking at a multiple-year horizon. Venture capital funds, when they’re built, are typically 10-year entities. So it’s not something you want to invest in if you need the money next year for your kid’s bar mitzvah or your daughter’s upcoming wedding. In other words, when you invest in venture capital, you’re investing for long-term wealth appreciation, because you’re betting on people who are going to change the world, literally, and hopefully for the better, in many cases dealing with critical and important areas that are facing civilization. Whether it’s climate change, or energy, or the food crisis, or cybersecurity. And these are issues that are really front and center on many, many people’s minds. And the companies that are being venture-backed in Israel and elsewhere are really taking big bites out of these problems. And we’re not expecting results and changes to happen in a matter of months or weeks. It’s going to take years. And that’s the time it takes to build a towering company from zero to billions of dollars. It’s not something you can sort of snap your fingers and say, abracadabra, and nobody does that. What it requires is a lot of vision, a lot of hard work, the ability to raise money, build teams, build products, create technology, and then find the right market fit.

TML: Some companies just don’t get there. They might have been the wrong choice.

This holiday season, give to:

Truth and understanding

The Media Line's intrepid correspondents are in Israel, Gaza, Lebanon, Syria and Pakistan providing first-person reporting.

They all said they cover it.

We see it.

We report with just one agenda: the truth.

Medved: That’s true.

TML: How many of them have you seen over the years? Can you look at a ratio? Can you really kind of do a kind of beta mapping of that?

Medved: There’s all kinds of data that has been collected over the decades that I’ve been involved in this business that say the majority of startups fail. It’s really only the minority that make it to the pot of gold at the end of the rainbow, and sometimes it’s a pot of silver or bronze, OK, but they get to some kind of a pot. What I can tell you at OurCrowd is that we’ve made 350 investments to date on our platform with the $2 billion. We also have 40 different funds that are operational. As an individual investor on the OurCrowd platform, you can either choose a single company, or you can choose a fund, which will diversify you in several companies, usually more than 10. So of this cadre, we’ve had 60 exits, 60 companies that have gotten to their happy ending, as it were, in most cases. And No. 2, we’ve had about 25 shutdowns, companies that have failed. So we’re running at about a two-to-one ratio of success vs. failure, but the majority is still outstanding. In other words, out of 350, we have about 275 that are still active, in there in the fight, and they will determine our overall ratio. But the key for people to remember is to diversify. You can’t go into this game and try to pick one company and call it an investment strategy. A strategy must contain diversification where you take a portfolio approach and you’re investing in 10 or 20 companies. Because you get a lot of shots on goal, you can be tolerant of mistakes and failures. And then you can also diversify across sectors, different areas of innovation as well as stages, companies that are from their earliest stages up to their latest stages.

OurCrowd CEO Jonathan Medved. (Courtesy)

TML: When the economy turns shaky, it follows that the new, innovative entries into the market are either frozen or pushed aside in favor of the venerable companies, so it really follows in terms of what you’re saying. What happens?

Medved: Look, we think that today it’s different. That innovation is really top of mind for many individuals. Look how popular interest is in innovation. You look at the media today. You read media here in Israel or elsewhere – it’s all about the next technology breakthrough. And I think the younger you skew, the more fascinated and involved in technology. We all realize that the world has changed remarkably over the last century and decades, but the change that’s coming, you haven’t seen anything yet. We are going to be living lives differently from a medical perspective, from an energy perspective, from a food perspective, from space, transportation, climate change. There’s just huge change underway. Some of it, by the way, not so good. There’s things we have to improve on. So what’s happening is that while big companies seem to sort of dominate, it turns out that the life expectancy of an S&P 500 company, that’s one of the top companies in the world, has dropped from 60 years to 12 years. Meaning that about 50 years ago, if your company had reached that pinnacle of success, meaning I’m one of the great S&P 500 companies, you are going to live on that index for 60 years. Now, according to the data, by the end of this decade, your life expectancy on that index will be 12 years. What it means is that essentially the young Turks, the innovators, are coming for you. And you either innovate or you die. Or you innovate or you slow down and you get knocked off your perch. There is simply no longer a sense that, OK, you know what, I’m in a tough economic time, I’m going to focus only on the big companies. In fact, what happens in some of these tough times today is innovation actually accelerates.

TML: It used to be “my son the doctor.” Today it’s “my son the techie.” But in reality, is that good? Too many people are leaving medicine.

Medved: Well, I think actually “my son the doctor” is a techie. Look at what’s going on in medicine. The most important medical device is probably that phone in your pocket or pocketbook. If you look at what’s going on with artificial intelligence in terms of diagnosis and reading X-rays and preventing prescription errors, that’s critical. If you look at the whole area of disease management, or drug discovery, it’s all becoming technical. I think that in fact, it’s simply more of a case that medicine, broadly speaking, has become completely driven by technology. And we in OurCrowd have 60 different medical companies, some of them doing amazing work, like Alpha Tau fighting cancer, or Memic providing the most flexible robotic surgery equipment, or Sight Diagnostics developing point-of-care blood testing with a couple of drops of blood. You’ve heard about similar companies doing things, except ours is actually FDA approved. And we think that the breakthroughs in medicine as a result of technology, especially coming from Israel, it’s not just going to make us significant money but it’s going to change our lives and extend our lives.

Young activist Jonathan Medved (L) and Steve Leibowitz, now a veteran Israeli journalist, co-directed the Israel Caravan promoting the country in 1986. (Courtesy)

TML: When you first began OurCrowd, did you even begin to dream that you would be dealing today with artificial intelligence, meatless meat, all these unusual things, even legal marijuana? There are so many other elements that have come into play in the last decade, and it changes the way investors look at what they’re going to invest in.

Medved: Yes, I think that the only thing that’s constant is change. And you have to really embody that understanding in your outlook. I think that if 10 years ago I had spoken about making investments in quantum computing, people would’ve looked at me and said, “What?!” And today everybody knows that our country in Israel is forging ahead in terms of bringing quantum computing. We in OurCrowd have already made eight different company investments in quantum computing. And over the next decade, you will see it become a huge driver of change in multiple areas. And no one really knew what it was 10 years ago. Today it’s about artificial intelligence going everywhere. It’s about the fact that food is not going to be grown and produced in any way that we remember traditionally being the only way to do it. We have a company which we’re invested in called Remilk who are literally growing milk proteins in vats in the most incredible way, where they think that they can actually do it cheaper than growing it with cows, and it’s healthier and better, and it will reduce greenhouse gases. We understand that almost 10% of the world’s greenhouse gas comes from the dairy industry. So here’s something where we can feed the world, get food cheaper, make it healthier, and help solve the climate issue, all in one technology, in one company. So we end up having investors who are investing because they think it’s a great idea, they think they are going to make money, which, God willing, we will, but beyond that, there’s a double bottom line. Because much of this investment can have a positive impact on all of our lives and on the future of humanity. So that by investing in some of these companies, you can both do good for yourself and do good for the world.

OurCrowd CEO Jonathan Medved (L) and former Jerusalem Mayor Nir Barkat, now a member of Knesset, share a hug at an OurCrowd Global Investor Summit in Jerusalem. (Courtesy OurCrowd)

TML: Jonathan, several years back we spoke about women in tech and how do we get women in tech. And really has that bridge narrowed? We’re seeing complaints that there aren’t women in tech.

Medved: It’s really a huge problem. And I’m, unfortunately, as guilty as most men in the technology area. There simply are not enough women founders, there aren’t enough women investors, senior partners at venture capital firms. There aren’t enough women CEOs. My late mother would say it’s a shandeh, it’s an embarrassment, to use a Yiddish word. I think that we have to as a society really continue to try to attract more women to the STEM science and technology and engineering areas. And I’ve seen it. I have a daughter and three sons. I was heartbroken when my daughter chose not to go – she was very technically inclined – into science or coding. She’s now, it turns out, an internet singing star under her name Yonina. So I guess it’s a little technical but she’s doing what she loves. I don’t think we can force this. I think we have to make sure that barriers don’t exist, that men are not preventing women from getting ahead. But I think we have to do a lot more. I spend much time soul-searching. I’m happy to hear from any listener or viewer with ideas and suggestions. And if there’s one thing I feel particularly compelled to do more it’s in that area.

TML: Let’s look over at the neighborhood. In 2020 there was an agreement signed with the UAE’s Phoenix Capital enabling Gulf state investors to access OurCrowd’s portfolio. A big deal for OurCrowd. So what’s been the outcome of that and the relationship between Israel and the UAE?

Medved: It’s really a long-term process. We are very active in building these bridges with our newly accessible neighbors in the Gulf. I liken it to the “Sand Curtain” just dropped, much like the Iron Curtain. And once it’s dropped, it’s not going back. The problem – and it’s not really a problem – is that most people think that this means instantaneous wealth, tons of money, deals a gogo, and it’s not working out that way. And that’s probably what I would have predicted. Because it’s really about building relationships, as opposed to starting to build transactions right away. Now the numbers look good. Trade and investment between Israel and the UAE are up almost tenfold in the year and a half, which is remarkable. Most recently, the UAE minister of economy predicted that there would be a $1 trillion of business done over the next decade between our two countries, God willing, inshallah. I hope that actually transpires. We’re working hard to make it work. But the most important thing is to build trust. And what we’re doing is we’re working to become, for example, licensed. We were the first Israeli financial group to get approval from ADGM, which is the Abu Dhabi Global Market [international financial center and free zone], to operate there. We’re actually making investments over there. So rather than just soliciting UAE money and other money to come into Israel, we’re actually investing. And we’re working together with literally dozens of partners, with our companies, to create new technology realities. And I think that people will very, very soon get used to seeing the Middle East as a whole lead in technology. I think that we are creating a much larger ecosystem between Israel and its Arab neighbors. And it’s not just the UAE, it’s many others including bigger countries as well who are slowly but surely joining this circle of trust and common endeavor. And I am very, very bullish on how this will play out over the next several years.

OurCrowd CEO Jon Medved and Dr. Sabal al-Binali, executive chairman, OurCrowd Arabia, in Dubai, Nov. 22, 2020. (Courtesy OurCrowd)

TML: Jonathan, Saudi Arabia is no secret. Israel and the Saudis have been doing business. It’s been quieter, it is starting to come out. What can you talk about? There’s no way OurCrowd is not involved.

Medved: I’m not talking about anything in that area other than the fact that we are excited about the direct air flights that have now been instituted [over Saudi airspace]. This is great for the world, it reduces greenhouse gas, it reduces travel time. The fact that we just shaved two and a half hours off of an average flight to Asia I think will connect Israel much more to the very, very important, fast-growing Asian markets. I think that the Saudis are very focused on technology, they’re building this incredible city on the Red Sea called Neom. I’d bet you that there will be cooperation in the future on that project as well as many, many others. But we’ve got to go step by step, we’ve got to be slow, we’ve got to be respectful and build relationships. And I think right now, premature discussion in the press is probably not what this process needs. It needs more work, and more technology sharing, more co-investment. And there will be plenty of headlines in the future.

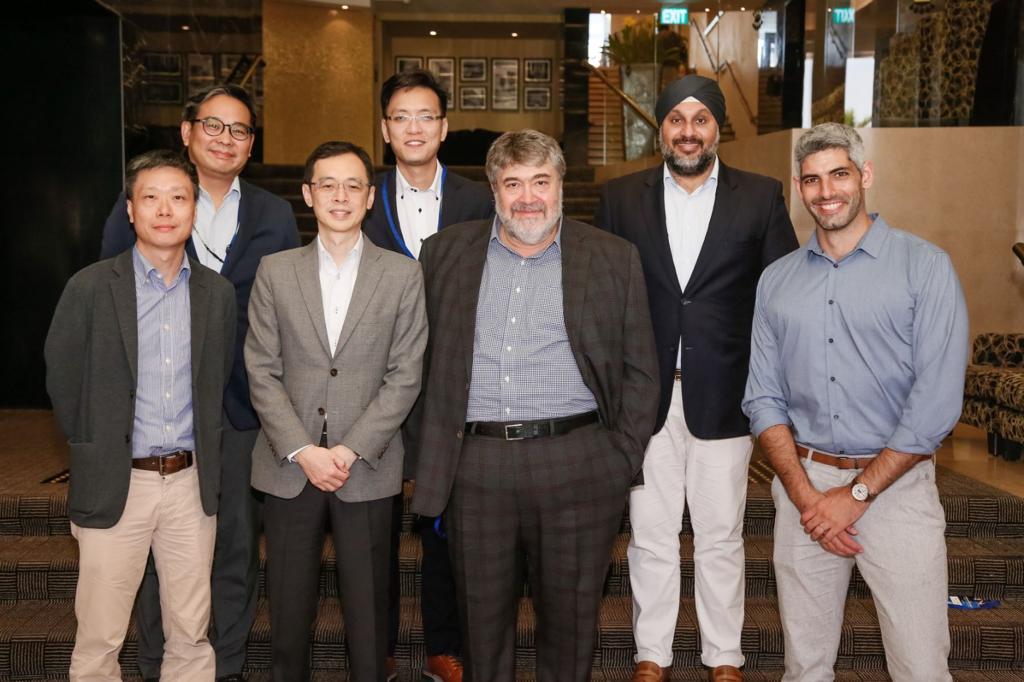

Senior representatives from large Singapore-based companies visit Israel to participate in a two-day event organized by OurCrowd and the Singapore Economic Development Board, July 2022. (Courtesy OurCrowd)

TML: Going back to your own neighborhood, the Israeli Arab, the ultra-Orthodox Haredi community, are you seeing more? Are you bringing more people from these communities into your network?

Medved: The answer is yes, but again, similar to what we spoke about before relative to women, I don’t think we’re doing enough, I think both us at OurCrowd as well as the overall tech community and ecosystem. I think that there are changes going on.

TML: The Palestinians – is there anything happening jointly anymore?

Medved: Sure. We have companies that are developing products and employing people in Ramallah, and there are still all kinds of efforts to get things going on that front. But I think what’s happened is that there’s been more focus on the broader integration of Israel in the region, which is the new kid on the block, it’s where people are most excited now. And that’s not just the UAE and Bahrain, but it’s also Morocco and countries beyond. And there’s a lot of focus there, there’s a lot of focus inside Israel, and still focus on the Palestinians. But I think there is an impact of the lack of, call it political process, between the countries on that economic reality, which, God willing, will improve over time.

TML: Jonathan Medved, young people look up to you as a role model, but who’s your mentor?

Medved: My dad. Unfortunately, he’s not with us anymore, but I got my start in business with my father. I guess many people join a family business. I was lucky that my family business was fiber optic communications, back in the 1980s when no one knew what it was. And I with my degree in history was able to learn a lot about technology and about business and about life from my father, who was a rocket scientist who taught himself to leyn [publicly read] from the Torah at a late age and had the best work/life balance of anyone I ever met. I miss him, and I try as much as I can to find other mentors among industry, but today I spend a lot of my time trying to mentor my team here at OurCrowd. I’ve got hundreds of people working with us, hundreds of companies that are part of our community. So while I continue to learn, and I want to continue to learn till the day I die, I’m more focused at the moment on transmission. And the ones I’m really focused on at the moment, big time, are my grandchildren, of which there are at the moment 12. I’m doing the best I can to really focus on their extraordinary growth.

OurCrowd CEO Jonathan Medved in Jerusalem. (Courtesy OurCrowd)

TML: Jonathan Medved, it’s been a pleasure to have you on. I knew your dad [David Medved] well – what a wonderful man. And I have to say that I’m just going to keep watching what Jonathan Medved is up to. Great to have you here at The Media Line.

Medved: Thank you, Felice. It was wonderful being with you.